Yahoo

Yahoo was created

only several years ago, in 1996 as a personal tracking system by David

Filo and Jerry Yang. Its value upon creation was worthless; it was only

considered a helpful tool to the two creators. Yahoo floated on the

NASDAQ and became a public listed company on April 12, 1996 and the IPO

price was $1.08. Yahoo has even had a maximum share price of $218.0312,

which occurred on the 10th of January 2000.

Yahoo was one of

the first search engines to be launched into cyber space and has become

the world’s most popular website. Its reliability in accurately finding

what the user is searching for has attracted many members. At this

instance of time, it receives 25 million visitors per month and a highly

accessible web site. Also, the immense databases from across the Internet

are gathered and categorised by about 30 professional surfers. Yahoo

is a resounding success and is far removed from the static definition that

applies to a Web search company.

The opening page is a brightly coloured, making it

look user friendly and only a few small icons are displayed so that the

loading time is short. It has facilities to personalise the user's search and it can find

anything the user wishes to find. The page has many different categories

of subjects that users can easily access using to the links. Yahoo has

many servers, which make it possible for the search to be carried out very

quickly, and users do not have to wait long to retrieve the desired

information. Yahoo can be viewed as a commerce-enabled, personal website

with e-mail facilities, reporting and payment processing, apart from

it’s search facilities. Below is a sample of the opening page of the

Yahoo Web site.

Yahoo does not

only exist as YahooUSA, there are also YahooEurope, YahooJapan and

YahooKorea as the company desires to build on a global user based company.

The Company has included online properties in 12 different languages to

accommodate for the ever-growing international consumer population. This

step also makes it more attractive for potential merchants seeking means

of advertising. Yahoo offices have been established in 16 worldwide

locations to ensure the development of their business.

To strive to

become a successful ‘dotcom’ you have to compete in the ever-growing

industry of dotcoms. As it is so easy to link to a competitor’s site,

the service that you provide must be the best. Otherwise, you simply drop

out of the game. As Yahoo was one of the very first search engines to be

launched, it has been capable of capturing the dotcom market. With its

superb services, it has become today’s most popular search engine,

despite the fact that there are many other out there competing fiercely

against it, e.g. AOL and Lycos.

Yahoo obtains

most of its profits by selling advertisements and services to large

companies. Obviously, these large companies are keen on investing in

advertising as Yahoo is so widely used and preferred all round the world.

As a result, investors evaluate Yahoo highly in the dotcom market.

As the hype about Internet companies such as Yahoo

increased, the stock market starts to move in that fashion (towards higher

share prices). It attracted a lot of interest from investors and

advertisers. This attracted even more interest and as more people entered

the stock market, the more enthusiastic they became. The demand for Yahoo

stock was so great but the supply was limited and this caused the share

price to rise.

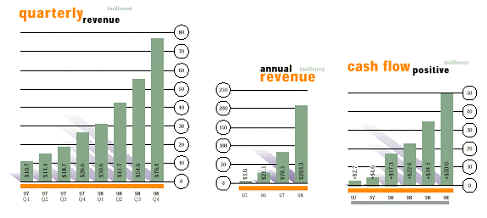

The following data obtained from the latest published

annual report 1998 was taken to show the progress of Yahoo financially.

The data shows the performance over the lifespan of Yahoo until 1998 and

it is evident that Yahoo has been reaping in profits, from the positive

cash flow, annual and quarterly revenue.

The above data contains statistics that investors and

speculators find attractive. Also shown is the data of income from

advertisers; this is very important because Yahoo obtains majority of its

revenue from advertisers.

A chart of

Yahoo's performance over its life span is shown below, beginning from its

first launch onto the NASDAQ. Considering the fact that Yahoo Is only

about 4 years old, it can be said that its performance is phenomenal as

the share price soared such a large amount in that little time. As

you can see, the general trend of the share price is increasing with time.

Its steep gradient and soaring share price can be regarded as an

indication of the expansion and success of Yahoo.

In comparison to blue chip companies, the gradient of

blue chip companies tends to be very flat, where else for Yahoo it is

obviously steep. This shows that dotcom companies are playing in a

different ball-field and that they are more likely to be in a stock

bubble, with ever increasing share prices, unless of course the bubble

bursts.

Also included below the share price chart and

indicated by the arrowheads are the dates of the stock splits. Yahoo has

split its stocks 4 times. What the stock split does is, for example, a 2:1

split, each shareholder obtains one extra share for each share that they

already own.

Splits:

2-Sep-97 [3:2], 3-Aug-98 [2:1], 8-Feb-99 [2:1], 14-Feb-00 [2:1]

Since the turn of the new Millennium, the share price

of Yahoo has fallen considerably, despite the fact that the share price

peaked in the beginning of January 2000. In just that one year, Yahoo

shares fell 16% following warnings that the economic slowdown would cause

profits to fall short.

More recently, just one day before the company

releases first-quarter earnings, Yahoo's (YHOO)

shares got trounced, along with other Internet stocks, dropping more than

5 points to $93.25. This fall occurred the day after a French judge forbid

the sale of Nazi memorabilia on Yahoo. The drop in Yahoo's stock price can

be partly attributed to two negative analyst reports from Merrill Lynch

and Morgan Stanley Dean Witter.

"These

stocks were almost going vertical. There wasn't much in the way of

analytics going on, it was almost pure emotion,” Piper Jaffray

technical analyst Ed Nicoski said.

The occurrence of this was exactly opposite to what

was predicted for Yahoo a year ago. Yahoo only began reaping in profits in

the last eight months and already, there are speculations that Yahoo is

overpriced and is heading for a great fall. Despite this, Yahoo has been

held up as one of the few Internet businesses actually turning a profit.

Yahoo plans to

keep up its performance by starting up new partnerships with companies

such as Hot Jobs Inc., which is also an advertiser for Yahoo and add new

content to the existing service. For the full year 2001, Yahoo

expects revenues to be $1.2 billion to $1.3 billion, business segments for

advertising/commerce and business services representing 80%-85% and

15%-20% respectively. As one can see, Yahoo depends a lot on advertising

for its revenues

As quoted from

the Yahoo COO Jeff Mallet, “We

want people to say ‘I may not know exactly where I’m going, but I know

that can get me there’”. This statement sounds very promising from

the point of view of facilities offered by Yahoo but this does not have

any correlation with the financial state that Yahoo is in.

“As an

Internet leader, Yahoo constantly reviews and enhances its products based

on consumer response and need,”

said Tim Brady, senior vice president, Network Services, Yahoo. "The improvements we are making in our commerce properties will

help ensure that we maintain the highest quality online experience

available to buyers and sellers."

Yahoo is a very

reputable dotcom company that has performed extremely well in the dotcom

market, even through times when other dotcoms have failed. It is often

used as an example of a dotcom company in an Index. Its performance

appears to fluctuate due to comments made by analysts in investment

banking and other external factors.

From the chart of

share performance, Yahoo’s performance is compared to the NASDAQ Index.

There is an obvious observation that both the graphs follow a similar

shape and they reach a peak at the same time. This shows that Yahoo’s

performance on the NASDAQ is closely correlated.

|