|

Amazon

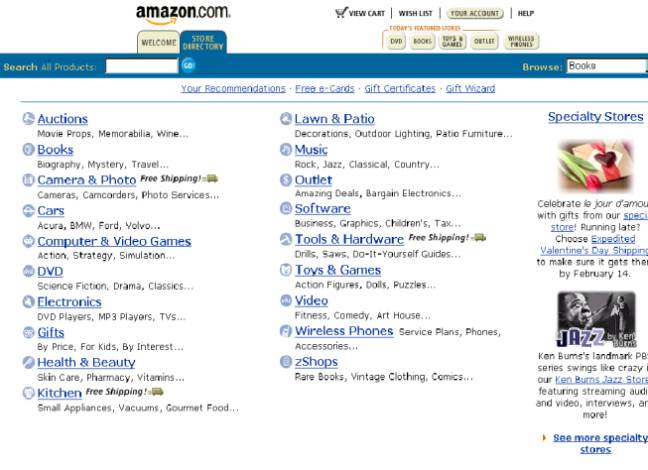

Amazon.com Inc. is an online retailer that serves

over 17 million customer accounts in over 150 countries. The products that

Company sells range from books, music and DVDs to toys, electronics,

software, video games and home improvement products.

Amazon.com also provides marketplace services such as

Amazon.com Auctions, zShops and sothebys.amazon.com. Such marketplace

services allow the buyers and sellers to come together on the Cyberspace

to make transactions happen, irrespective of time and place. With the

Internet, these marketplace services transcend the limits of time and

geographical boundaries.

Being a representative company in the newly emerged

field of e-commerce, Amazon.com, the largest online retailer that has a

heavy reliance on the Internet technology, has proven to be one of the

most prominent technology leaders in the field. Significant investments of

the Company are in the area of engineering new user-friendly software.

Some of its remarkable innovations include the 1-Click technology,

personalized shopping services, powerful easy-to-use search engines as

well as other browse features and wireless access to the Company’s

stores.

Is Amazon.com an economic bubble then?

Before coming to a conclusion, we shall take a closer look at this

NASDAQ-listed company.

3 Segments of Business

First founded as an online bookstore, Amazon.com has

developed rapidly and diversified its businesses. The Company is now

primarily organized into 3 major operating segments,

US Books, Music

and DVD/Video Segment – Over 13 million titles in books, music and

DVD/video are offered for sale on the web page now. As a highly

customer-oriented company, Amazon.com has expanded its bookstore and

diverted lots of resources to enhance the customer’s shopping

experience. Just in the year 1999, the Company, in partnership with

experts in certain fields, enriched its editorial content and introduced

new specialty stores such as its professional and technical store.

Millions of out-of-print titles are still available

at the store. In order to have a more in-depth understanding of how

immense the collection of titles is at Amazon.com, our project research

team attempted to find several very outdated CD singles from a local Hong

Kong singer, Jacky Cheung. Surprisingly enough, all are still available at

Amazon.com, though at rather high prices. Another notable achievement of

the Music store is that it is in fact the first major online music

retailer to dedicate an area of its store to free, full-length song

downloads from established artists and major-label performers.

Consequently, both the Music store and DVD/video store have seen

significant upsurge in total revenue. Product recommendations services

were improved at the Music Store while the DVD/video store continued its

integration with its Internet Movie Database (IMDb) Web site, a leading

online information source for movie enthusiasts. The Company has also

created and hosted several official web sites for a number of popular

movies such as “American Beauty”.

International

Segment – In the year 1999, the Company used to have only two

internationally focused web sites, www.amazon.co.uk and www.amazon.de. By

now, the number of international sites has grown to 4, with the addition

of www.amazon.co.jp and www.amazon.fr. Both amazon.co.uk and amazon.de

were ranked the number one most visited e-commerce site and the number 10

most visited site overall in the United Kingdom and Germany, respectively,

according to the Media Metrix ratings for Europe released in January 2000.

Services and products offered by these international sites are tailor-made

for the local markets.

Others Segment

– This segment includes all other areas of businesses like the

Wireless Phones, Gifts, and the aforementioned marketplace services like

zShops and Auctions. The sectors that perform best in this segment are

undoubtedly the marketplace services. During the fourth quarter of 1999,

these marketplace services surpassed a combined 1 million registered users

and 1.5 million listings. Since its launch in November 1999,

sothebys.amazon.com has achieved average close rates, which are rates of

actual purchases by customers bidding at the site, in excess of 50% and

average auction closing prices of over $500.

Technology

Web Site Format

– Amazon.com is mostly written in html, the most widely accepted

language for homepage publication, though not the one that produces the

best multimedia effects.

1-Click

Shopping – 1-Click Shopping is an innovation of Amazon.com, which

sets it apart from its competitors in the online shopping industry.

Once the customer has placed his/her first order with Amazon.com,

1-Click shopping can be turned on, such that to buy an item only requires

1 click on the item. Then the

customer’s credit card will automatically be debited and the item

shipped to the pre-registered address in due course.

Such a technology has significantly made online shopping easier and

has largely contributed to the unprecedented growth rates in revenues of

the Company.

Security over

Payments – The greatest concern over the transactions on the

Internet has always been security. Since

transactions carried out over the Internet mostly rely on credit cards,

proper encryption methods are required for secure transmission of personal

data. Amazon.com assures its

customers of security by offering the Amazon.com Safe Shopping Guarantee,

which basically guarantees that it would cover all the liability of

fraudulent credit card charges out of shopping at Amazon.com.

The encryption method used is the popular industry security

standard called 128-bit Secure Socket Layer (SSL), which encrypts the

customer’s personal information including credit card number, name, and

address, so that it cannot be read as the information travels over the

Internet.

Amazon.com Inc. is traded in the US stock market

under the symbol AMZN. It is probably the most volatile in the pool of

constituent stocks of NASDAQ. Its IPO was in May 1997, about a year before

the series of upsurges of share prices of the dotcom companies. In the

first year of its trading, the Company’s shares were traded at price

range under $10 and the Company was showing steady and sustainable growth,

without any observable dramatic fluctuations in its share price. However,

between Sept 98 and May 99, its share price skyrocketed from around $10

per share to over $110, a remarkable increase of 1100% within 9 months.

The peak value of the Company’s stock was attained in Dec 1999, when the

whole market was investing in Internet stocks speculatively. Its peak

value is $113 and is more than 5500% higher than its price at its IPO!

After that, panic hit due to the frequent release of information on

the Company’s huge amounts of losses. The share price of the Company

dropped by 90% of its peak value to the price range of around $10 to $20

per share.

Amazon.com was admittedly a pioneer in using the

Internet to change a distribution channel.

Yet, think about it: the demand for books and other goods on sale

on Amazon’s homepage has not increased and probably never will. Though Amazon.com has made the transactions over the Internet

much more efficient, given the fact that the demand for the types of goods

on sale has not changed, why should their stock price skyrocket?

Their stock price should not be based on the growth and potential

of the Internet, other than its effect on Amazon.com’s market share and

its potential increase within the respective markets.

Therefore, should Amazon.com be worth more than existing

booksellers, which own assets of higher liquidity like book stores and

land? Compare the share price

with Barnes & Noble, Inc., which is another major bookseller in the US

(plotted in blue). Barnes

& Noble are also of course on the Internet now.

Which then should be worth more?

Was the market rational?

A decline in losses is predicted in 2000 at Amazon.com. The current

forecast expects losses will decrease from 1999's per share figure of

$-2.20 to $-1.19. At this time, losses are expected to again decline in

2001, with losses in the area of $-0.69 are considered likely.

According to most of the analysts’ reports, the investment

community's confidence in the earnings forecast is at the top of the scale

statistically. Yet, any significant variation of actual results from

expectations could have a very adverse effect on the price of company

shares.

The dramatic rise and fall of Amazon’s share price

is indeed attributable to the irrationality that prevailed in the market

in the last year or two. Admittedly,

Amazon.com has a lot of potentials to become the most influential online

seller, yet its share price was artificially pushed to an irrational high

due to speculative activities and market sentiments.

Given the fact that Amazon.com is not creating any demand, its

rational value should never be overwhelmingly higher than its competitors

like Barnes & Noble. From

this perspective, it can be seen that Amazon.com indeed was a bubble, and

that the bubble has already burst.

|