|

Cisco Systems

Cisco Systems is a Business-to-Business

telecommunication network company with market capitalisation of over $3,700 billion and over 34,000 employees around the world.

The company controls more than three-quarters of the global market for

products that link networks and power the Internet, including routers and

switches. It also produces dial-up access servers and network management

software. The company has a broad set of product offerings and

technologies, which include Ethernet, Gigabit Ethernet switching, Token

Ring, ATM switching, SONET/SDH, xDSL, dial-up access, converged data,

voice, and video technologies, Tag Switching, optical transport, wireless,

content networking, call centre and unified messaging solutions,

networking security as well as network management software solutions.

Cisco typically purchases companies to acquire

technology or products that it has neither the time nor the capability to

develop itself (it has made close to 70 acquisitions since 1993, they have

acquired companies which are worth over $10 billion this year). It has an

advantage over large companies such as Oracle, which insists on developing

its own new technologies and products rather than acquiring them. This

means that Cisco can look at thousands of research projects from small

private and public companies before choosing the best, whereas Oracle has

to make decisions on where to put resources much earlier in the game.

Cisco also pursues strategic alliances with other industry leaders in

areas where collaboration can produce industry advancement and

acceleration of new market. The objective and goals for a strategic

alliance includes: technology exchange, product development, joint sales

and marketing and new-market creation.

In the Fiscal year 2000, Cisco expanded or entered

into alliances with Cap Germini/Ernst&Young, HP, Intel, IBM, KPGM

Consulting, Microsoft, Motorola, oracle, Sun Microsystems and Telcordia.

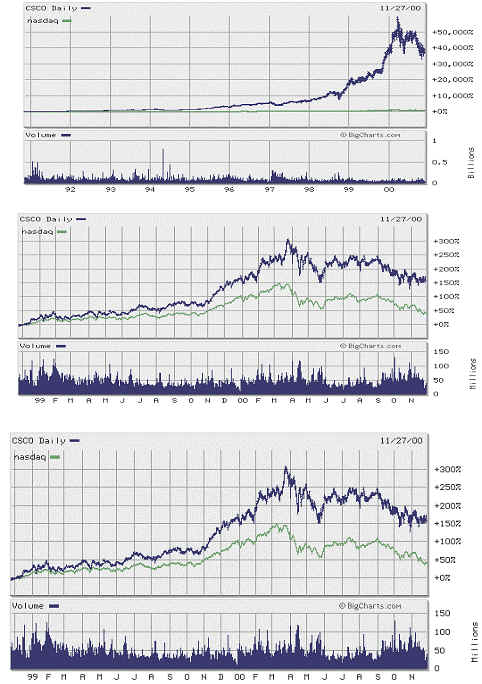

Cisco Systems was a well-regarded private company that did not become

public listed until May 1990. It was down 10% over its first four months,

but by the end of the first year it had a 155% gain. It was up 659% over

its first two years, 1,315% over its first three years, 2,470% over five

years, 7,494% over seven years and 34,930% by its ninth year (See diagram

below).

The share value of the company has been rising ever

since the company was first founded in 1990, nevertheless there were

several market corrections over the years.

The drop in share prices in May this year was one of them; it was

triggered by the release of Labour Department’s report, which showed

U.S. unemployment was at the lowest level in three decades.

Low unemployment means a tighter labour market, which tends to

drive up wages. That would

increase the chance of the Federal Reserve in raising the interest rates

as a result. Investors

panicked about the impact of further interest rate increasing, and that

was the force of the driving correction.

Tech stocks are sensitive to interest rates for

different reasons.

Their high valuations are based on low interest

rates.

Their interest payments would go up with higher

rates.

Cisco share value dropped further after an analyst

from Merrill Lynch raised the questioned of whether Cisco could maintain

its acquisition growth rate as the company would need to continue to grow

at 30% a year for the next nine years in order to sustain its current

valuation.

When Cisco’s earnings report was released in the

July’s quarter, their results exceeded the expectation of Merrill Lynch

with revenues of $5.720

billion, $245 million over the estimated value, and signs of slower US

growth have cause the investor to think that inflation pressure is at its

peaked, the share value then rebound.

The share price was brought back down again in

October even though the company reported October quarter results again

exceeded expectations. The

downtrend was the consequence of a number of reasons and the uncertainty

in the U.S. economy. They are as follows:

Profitability in numerous industries could be

affected by the outcome of the presidential election - The technology

industry is heavily influenced by the outcome of the presidency election. There is a significance difference between the key issues

raised by the two candidates, which may or may not favour the sector.

The issues are as follows: the violations of personal privacy by

e-commerce companies, taxation of interstate internet transactions,

copyright protection of entertainment material, open access, improving the

bandwidth of wireless spectrum auctions and violations of antitrust

regulations in B2B commerce.

A number of leading US technology companies

pre-announced that its revenue and earning for the September quarter would

be substantially below the expected value, this announcement results in a

down turn for the whole of the tech sector.

Finally the rising oil prices and a weakness of the

Euro have weighed on the economy sector and were seen as a negative impact

by the investor.

Cisco’s homepage (www.cisco.com)

is not particularly attractive or interesting, however the well structured

and the absence of complex animated advertisement has enable clients to

scrutinise the page without much of disruption. The homepage is linked up with other Cisco Systems around the

world with different languages, which enable customer to access the page

without the language barrier.

Cisco also offers a wide range of products for

purchases online and a step-by-step guide, which assist you throughout the

transaction. In order to keep

in touch with clients, the company encourages customers to sign up and

become a member and they will notify you with up-to-date news or when a

new product has been launched in the market.

The latest earnings report from Cisco was impressive

and again exceeded the market estimation with revenues rose 61% to 5.72

billion, almost $245 million above the estimate.

Revenues rose 16% from the previous quarter, Cisco’s eighth

consecutive quarter with double – digit sequential revenue growth.

Their router sales increased by 61% to $2.4 billion,

representing 42% of revenues, while switches sales grew by 52% to $2.3

billion, representing 40% of the revenues.

Other products, which include optical systems and professional

services, increased by 148% to $1.2 billion, or 18% of the revenues.

In the Cisco fiscal 2000 Cisco has Total Revenue of

$18,928 M and a Net Income of $2,668M, a gain of 55% and 31.9%

respectively over the year ago period.

Cash flow = (Cash and short term investment / Total

assets) * 100%

= ($5,525M / $32,870M)

* 100%

= 16.81%

Other current assets = [(Total current assets –

Cash and short term investment) / Total assets] * 100%

= [($11,110M – $5,525M) / $32,870M] * 100%

= 16.99%

Long – term assets = [(Total assets - Total current

assets) / Total assets] * 100%

= [($32,870M – $11,110M) / $32,870M] * 100%

= 66.2%

Current liabilities =[{Total liability - (Deferred

Income Tax + Minority interest)}/Total liabilities and shareholders’

equity]* 100%

=[{$6373M – ($1,132M + $45M)} / $32,870M] *100%

= 15.81%

Long – term liabilities = [(Deferred Income Tax +

Minority interest) / Total liabilities and shareholders’ equity]* 100%

= [($1,132M + $45M) / $32,870M] * 100%

= 3.58%

Shareholders’ equity = [Total Equity / Total

liabilities and shareholders’ equity]* 100%

= [$26,497M / $32,870M] * 100%

= 80.61%

Cisco Systems should not be considered as a bubble

company since the company has an ideal cash flow every fiscal year. Sales

over the Internet have risen by almost 50 % since last year and the

company’s earnings report have shown that their net income is constantly

higher than expected. These

performances reflect that the growing demand for Cisco’s access product

still remains robust. However,

despite the success from the earning reports, the share value of the

company is often in contrast, there are factors such as economical and

political reasons which can cause the share value to fluctuate.

Unlike a typical dotcom company, Cisco has a clear

business and strategic plan, which is to acquire companies with

technologies, which they are incapable to produce and to pursues strategic

alliances with other industry leaders to collaborate and produce the most

advance technology in the market.

|