|

Freeserve

Freeserve was launched in September 1998 by the Dixon

Group. It was the first ISP to offer subscription fee free Internet access

for the cost of local phone calls in the U.K..

Today its franchise has a 35% share of home Internet access

(approx. 3.5 million users).

On 2nd August 1999, after only ten months of

operation, Freeserve was listed on the London Stock Exchange and the

NASDAQ. The Dixon Group continues to own approximately 80% of Freeserve.

On 17th March 2000, Freeserve joined the FTSE 100 index of major UK

companies, employing only 200 people.

Today, Freeserve is also considered to be the largest

Business-to-Business (B2B) company on the World Wide Web and one that

pursues a very aggressive business strategy.

The following list emphasises how rapidly Freeserve has grown in only two

years and how aggressive their strategy is. The company today offers:

-

a free and simple narrowband Internet connection,

without a subscription fee including e-mail, 15 megabytes of personal Web

space and online 24 hour telephone support and two unmetered Internet

access propositions as well as broadband internet

-

a wide selection of

UK-focused e-commerce offerings, through shop@freeserve,

Freeserve Marketplace, iCircle,

and FSauctions

-

a variety of Internet tools

and services, including leading a search engine from Inktomi and

communications tools such as Speechmail, FSmail, e.notifier and Telserve

-

an ever broadening range of

community tools, including Smartgroups,

2-dimensional and 3-dimensional

chat, Web page building, forums, group calendars and e-mail

-

Clearlybusiness.com,

a portal for small businesses jointly developed by Freeserve and Barclays

PLC and coming soon, in joint venture with Bradford & Bingley Group, a

property channel featuring a searchable database of homes for sale,

financial services.

-

joint ventures for online

share trading (StockAcademy.com),

personal insurance (InsureanceWide.com) and motoring e-commerce (Fsmotorist.co.uk)

The homepage (www.freeserve.com)

is attractive with many links to all its sub-companies and a lot of

advertising, such that it seems confusing upon first sight. Subsidiary web

pages however, are very well structured and the contents bar is very

useful and one is able to find the relevant information quickly.

Furthermore, the structure is consistent throughout all the pages and is

easy to use as soon as one as grasped its information flourishing concept.

On Freeserve's pages one can find information

concerning, motoring, properties, actions, sports, e-commerce, online

shopping, travel, new, careers, entertainment, etc. The web page also got

it’s own reliable search engine which is fast and one is able get nearly

everything on Freeserve’s web pages what is nowadays offered on the web.

When registering with Freeserve one is also able to

customise his/her web page, which makes it consumer orientated i.e. user

friendly.

On the whole, the web page’s appearance, options

and structure are well designed. However, for the traditional home user

with a 56k modem, all the bandwidth consuming features like applets makes

surfing in their domain quite slow.

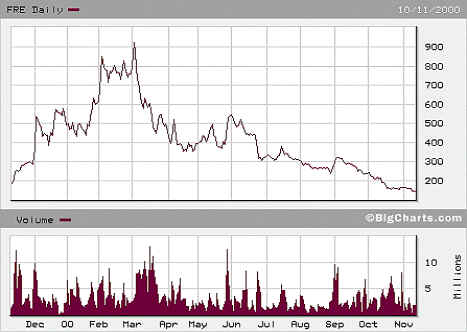

Freeserve became public listed on 2nd August 1999 and

the IPO was £1.50 per share, when Dixon released approximately 20% of its

shares. The flotation raised net proceeds of approximately £125 million

and the shares are traded in London on the main London Stock Exchange

(symbol FRE) and on the NASDAQ Stock Exchange (FREE). The current

(December 2000) share value is approx £2. However the shares price did

not increased steadily. It fluctuated strongly and was once valuated at £9.20

in March 1999. From this point onwards, the shares fell gradually and

fluctuated to today’s value.

It becomes evident from the graph that the stock

price didn’t evolve smoothly; it has a lot of peaks, which reflect the

vulnerability of the share. The following analysis will look at the main

stock market fluctuations of the share and give an explanation for those,

taking into account Freeserve’s financial performance, press release,

investor’s evaluation criterion and the theorem of stock market bubbles

into account.

At the beginning of December 1999 Freeserve’s share

price nearly doubled from £2.80 to £5.30 inside three days. The main

reason for this was the announcement of a strategic partnership with BT

Cellnet (genie.co.uk) to develop mobile Internet services. The press

release on the 2nd of December confirmed this and this further

increased the stakes by stating: ‘that

the leading edge of mobile Internet applications available today are just

the tip of the iceberg’. This information was apparently enough, at

that time, for the overconfident investors, who often are day traders,

i.e. speculators, to buy these shares. As only 20% of the shares were

available to the public, the demand for the shares was so great that a 95%

increase in share price occurred. However, the share price then fell again

by 20%, which proved the volatility of the share as the speculators

quickly sold their share due to the large yield. This share price, at that

time would not be classified as a typical stock market bubble due to this

important deal with BT and its economic value for the future of the

company.

In the middle of February 1999 the stock price rose

again by a 100% until the beginning of February. John Clare, chief

executive of Dixons Group declared on 12th

January that Freeserve is "not a pure ISP", and claimed that the

company is ahead of AOL in the move to provide content to

customers. The rise was not due to economic reasons, but due to his

statement and figures like 70% increase in Internet subscriber in the last

quarter and a 50% increase of the web page impressions. Apparently this

was enough evidence for investor to buy their shares. This rise fits the a

typical stock market bubble as the share value is hyped up only by soft

indicators like customer increase and turnover increase, however, not by

economic profit and the earnings to price ratio.

The stock price reached a peak at the 2nd

of May at a £9.20 and then the bubble burst. The share price started to

drop; the investors panicked and sold of their shares, which caused a

landside halving the share price within a week.

The exact reason for the offset of this crash has

several causes. Firstly, the overall stock market collapsed at this time

and Freeserve shares suffered due to this. The main part of this report

looks closely at what determines the overall market performs.

Secondly, investors, especially investment brokers/Banks might have

shifted their criterion for evaluating the share and taken the long-term

economic profit as a main criterion for the valuating the stock value.

This had not been very promising as the company made huge losses.

When investigating Freeserve's economic performance, the annual

report 1999/2000 revealed an operating loss of 23 million pounds (see

Operating loss). An increase of tenfold compared to the previous year.

Taking the P/E ratio as the main criterion for the stock market value

would therefore certainly justify the crash. It was probably the case that

investors lost faith in the long-term profitability of the company, and an

emphasis was placed on economic profit.

The market today is still very sceptical toward

Internet companies and Freeserve is now valued at about two pounds a

share. This is still 25% up on the issue value in August 1999. This seems

reasonable, as Freeserve has grown very quickly getting 3.5 million users

in less then two years and becoming the leading e-commerce site on the web

due to its overall aggressive strategy. These impressive figures caused

their early stock price increase. However, as analysts and investors took

their financial performance into account, the ‘bubble’ burst, giving

rise to the strong market correction, making today’s value more

appropriate. |